Discover more from From Symptoms to Causes

Inflation and the Elephant in the Room

Therefore, there are two phases to inflation. First is the euphoria while the economic mistakes are being made, then comes the reckoning, as the value of the money is adjusted.

I recently came across this excellent article that explains in simple terms the reason for the current spiking inflation. The author focuses on the Icelandic economy, but the situation he describes and the arguments he puts forward apply to more or less the whole world.

This article is written by Icelandic engineer Jóhannes Loftsson, a brave and bright man who has been at the forefront of the resistance against the disastrous Covid-19 policies right from the outset.

— Thorsteinn Siglaugsson

Recently, quite a peculiar debate has arisen in Iceland regarding the root cause of the prevailing inflation spike, with accusations flying in all directions. Some blame tax increases, others blame price gauging merchants, and still others blame the wage greed of the working class. All of this is incorrect, as these are mere consequences. Silence still reigns on the true cause of the inflation: All current inflation can indeed be traced back to government mismanagement during the COVID era.

But what is inflation? Economist Milton Friedman explained this quite well in a number of lectures: Inflation is an adjustment in the value of money after an imbalance has been created between the amount of money in circulation and the quantity of goods produced.

It's best to explain this with an example: If authorities were to suddenly allow people to print their own money, at first there would be a period of euphoria as all these new millionaires would go shopping. However, as goods in stores started to run out, merchants would react by raising prices. The value of the money would thus be re-adjusted, and before long, the money would be worth no more than the paper it was printed on.

Therefore, there are two phases to inflation. First is the euphoria while the economic mistakes are being made, then comes the reckoning, as the value of the money is adjusted.

It's crucial to understand that once worthless money has been put into circulation, there's nothing in this world that can prevent the ensuing inflationary spike. The damage is done, and the consequences are inevitable.

Once the damage is done, the central bank's tools also become ineffective. Take the interest rate, for instance. Just as you can't reduce oxygen intake by holding your breath, a short-term interest rate hike won't suffice. For as soon as the central bank abandons its high interest rate policy and lowers the interest rate again, the effects reverse and prices rise again. Interest rates only smooth out the inflation curve, but over a longer period, the overall inflation spike remains the same. If interest rate hikes go too far, inflation might even increase over the long term. No one can solve shortage of housing by ceasing to build houses, and now interest rates have made borrowing so expensive that construction is stalling. When interest rates are reduced again, housing prices will become even higher than before the interest rates were raised, for then the need for housing will have increased even more.

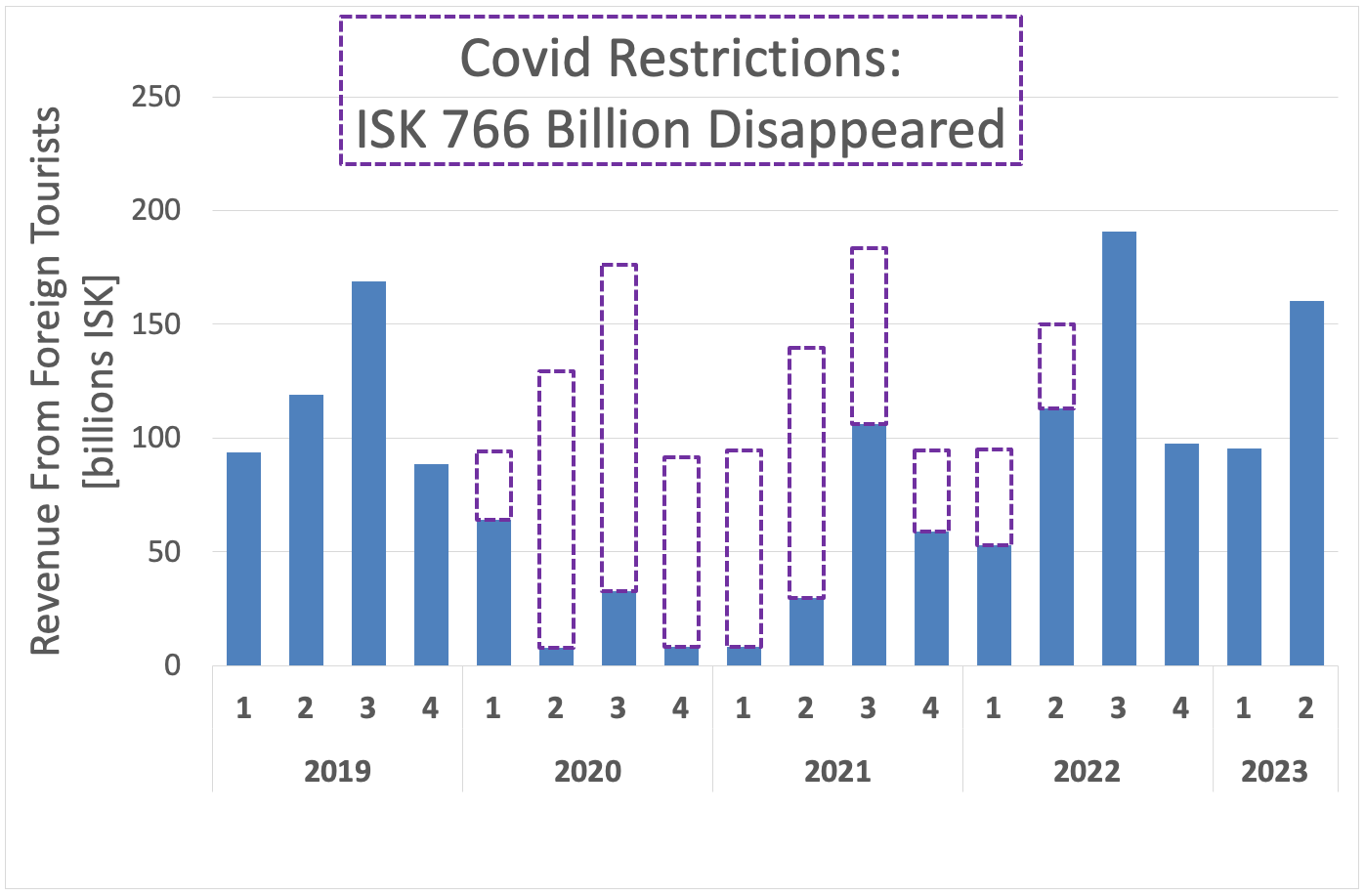

The only time the central bank could have acted was at the time the economic mistakes were being made. Mistakes everyone refused to recognise, but should have been blatantly clear to all: Fascist pandemic measures carried out by the authorities, that halted the value creation of the country's major industries for over two years. The production gap between 2019 and 2023 was enormous, close to 800 billion ISK. To mask the downturn, the authorities consciously decided to print money non-stop. Interest rates were lowered below the inflation rate, rescue packages were distributed all over, and a new state-financed pandemic industry was pushed into existence out of nowhere. Such a monetary policy of printing money and halting production is actually the recipe for a massive inflation spike, exactly as Milton Friedman warned us of.

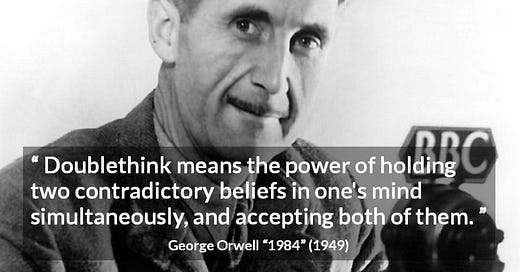

The reality-escape party began, and everything was done to prevent the public from realising the economic damage the irrational border closures were causing. Had this not been done, this self-destructive economic policy would have ceased almost immediately, as people would have felt the recession on their own skin right away, and risen up against the injustice.

It's unlikely that the authorities did not know they were loading the inflation cannon. But instead of warning people, they were encouraged to max out their debts with low interest rates and new mortgages for the lowest earners. The complicity didn't stop there, because when it came to avoiding responsibility by blindly following a pandemic strategy concocted by the pharmaceutical companies themselves, all political parties were in the same boat, as they all agreed with the actions.

It's no coincidence that none of them wants to see the elephant that has now trampled everything in the room. This is their elephant. They created it themselves.

https://www.goodreads.com/quotes/685739-if-the-management-consultant-said-tersely-we-could-for-a

“If," ["the management consultant"] said tersely, “we could for a moment move on to the subject of fiscal policy. . .”

“Fiscal policy!" whooped Ford Prefect. “Fiscal policy!"

The management consultant gave him a look that only a lungfish could have copied.

“Fiscal policy. . .” he repeated, “that is what I said.”

“How can you have money,” demanded Ford, “if none of you actually produces anything? It doesn't grow on trees you know.”

“If you would allow me to continue.. .”

Ford nodded dejectedly.

“Thank you. Since we decided a few weeks ago to adopt the leaf as legal tender, we have, of course, all become immensely rich.”

Ford stared in disbelief at the crowd who were murmuring appreciatively at this and greedily fingering the wads of leaves with which their track suits were stuffed.

“But we have also,” continued the management consultant, “run into a small inflation problem on account of the high level of leaf availability, which means that, I gather, the current going rate has something like three deciduous forests buying one ship’s peanut."

Murmurs of alarm came from the crowd. The management consultant waved them down.

“So in order to obviate this problem,” he continued, “and effectively revalue the leaf, we are about to embark on a massive defoliation campaign, and. . .er, burn down all the forests. I think you'll all agree that's a sensible move under the circumstances."

The crowd seemed a little uncertain about this for a second or two until someone pointed out how much this would increase the value of the leaves in their pockets whereupon they let out whoops of delight and gave the management consultant a standing ovation. The accountants among them looked forward to a profitable autumn aloft and it got an appreciative round from the crowd.”

― Douglas Adams, The Restaurant at the End of the Universe

Each country seems to have their own explanation for their inflation. Odd that all of the nations are experiencing the same thing, isn't it?